Products You May Like

AMD and Nvidia hit all-time highs on Thursday as investors continue to clamor for shares of the companies building chips that power artificial intelligence.

AMD shares rose over 1% during trading on Thursday to reach its highest-ever closing price, $162.67, while Nvidia, rose just under 2% to $571.07. Both companies have notched double-digit percentage gains to start the year after an explosive 2023 in which AMD shares popped 127.6% and Nvidia stock rocketed 238.8%.

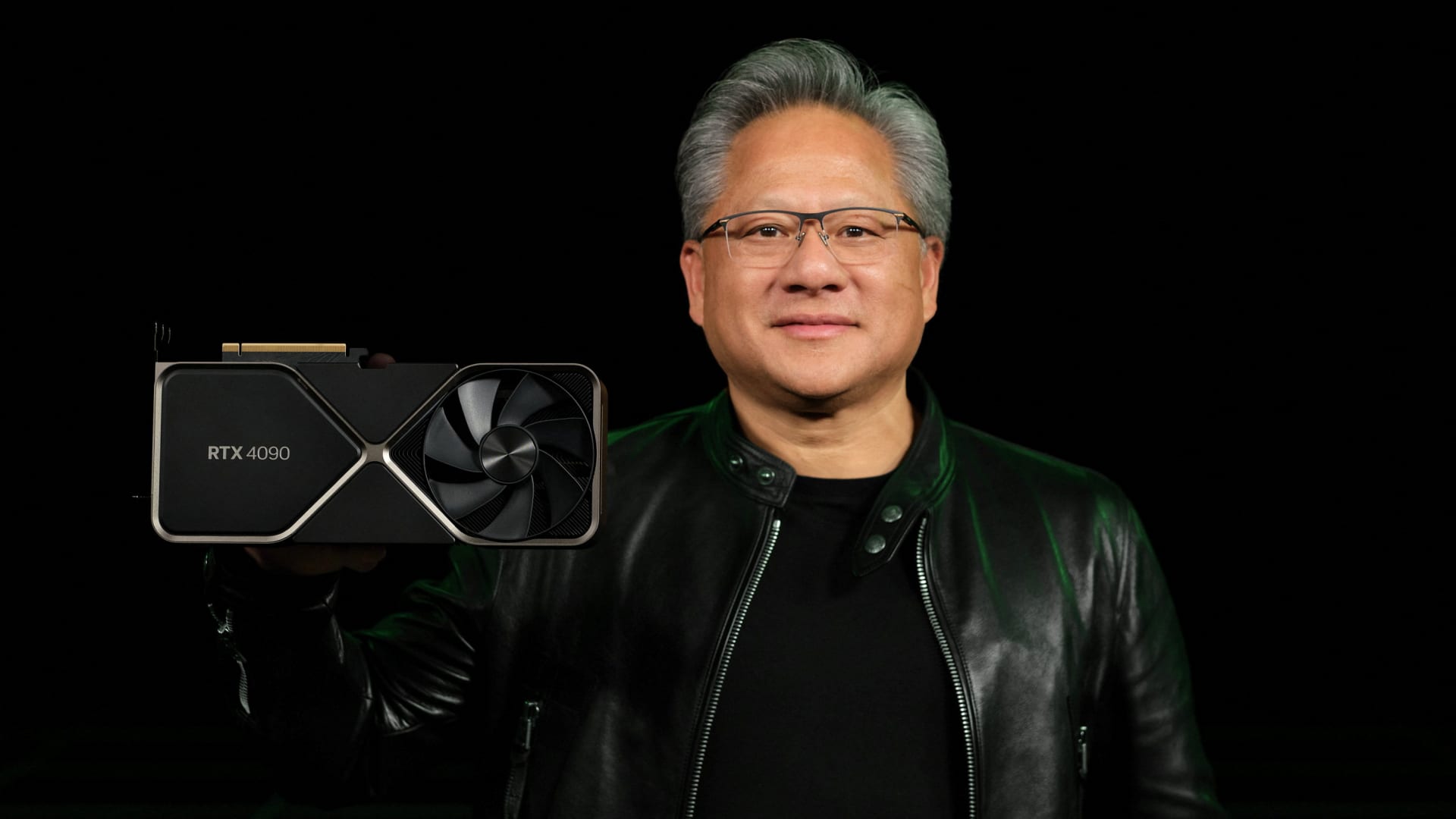

The record valuations reflect continued investor interest and hunger for companies that design and sell graphics processors for artificial intelligence. GPUs were originally designed to play computer games,. But they’re also essential for training and deploying intricate AI models like OpenAI’s GPT, leading to a massive surge in sales for the chips.

Nvidia has been the primary GPU supplier to AI companies for the past two years and was the best-performing stock in the S&P 500 last year.

Investors are increasingly bullish on AMD, the second-largest standalone GPU maker. the company announced last year a new chip that could compete with Nvidia’s H100, which is currently the standard for AI applications.

Analysts also see AMD improving its AI software, eliminating one major reason why Nvidia chips were preferred over AMD’s.

On Thursday, Taiwan Semiconductor Manufacturing Company, which manufactures Nvidia and AMD chips, reported better-than-expected sales. CEO C.C. Wei said that there was strong demand for AI chips, which use the most advanced manufacturing techniques.

TSMC management believes manufacturing AI chips could represent a “high-teens” percentage of its revenue in five years, which has positive implications for both Nvidia and AMD, Goldman Sachs analysts led by Toshiya Hari wrote in a note on Thursday.

Separately, Meta CEO Mark Zuckerberg, one of the largest buyers of GPUs, announced plans on Thursday to buy billions of dollars worth of Nvidia and other GPUs this year.