Products You May Like

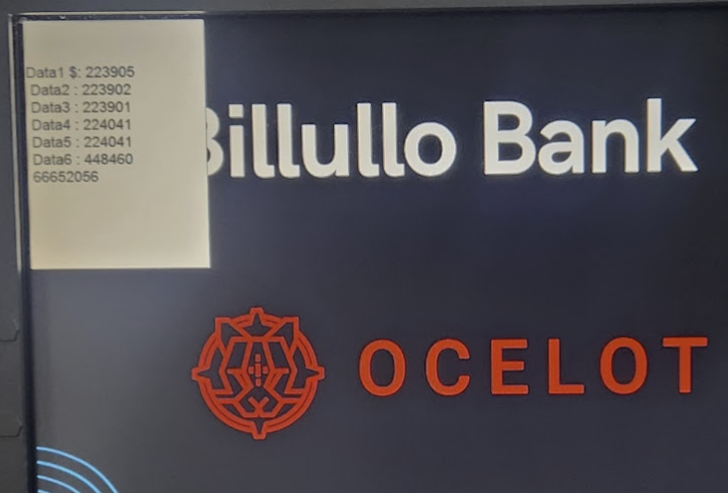

A new ATM malware strain dubbed FiXS has been observed targeting Mexican banks since the start of February 2023.

“The ATM malware is hidden inside another not-malicious-looking program,” Latin American cybersecurity firm Metabase Q said in a report shared with The Hacker News.

Besides requiring interaction via an external keyboard, the Windows-based ATM malware is also vendor-agnostic and is capable of infecting any teller machine that supports CEN/XFS (short for eXtensions for Financial Services).

The exact mode of compromise remains unknown but Metabase Q’s Dan Regalado told The Hacker News that it’s likely that “attackers found a way to interact with the ATM via touchscreen.”

FiXS is also said to be similar to another strain of ATM malware codenamed Ploutus that has enabled cybercriminals to extract cash from ATMs by using an external keyboard or by sending an SMS message.

One of the notable characteristics of FiXS is its ability to dispense money 30 minutes after the last ATM reboot by leveraging the Windows GetTickCount API.

The sample analyzed by Metabase Q is delivered via a dropper known as Neshta (conhost.exe), a file infector virus that’s coded in Delphi and which was initially observed in 2003.

“FiXS is implemented with the CEN XFS APIs which helps to run mostly on every Windows-based ATM with little adjustments, similar to other malware like RIPPER,” the cybersecurity company said. “The way FiXS interacts with the criminal is via an external keyboard.”

With this development, FiXS becomes the latest in a long list of malware such as Ploutus, Prilex, SUCEFUL, GreenDispenser, RIPPER, Alice, ATMitch, Skimer, and ATMii that have targeted ATMs to siphon money.

Discover the Latest Malware Evasion Tactics and Prevention Strategies

Ready to bust the 9 most dangerous myths about file-based attacks? Join our upcoming webinar and become a hero in the fight against patient zero infections and zero-day security events!

Prilex has since also evolved into a modular point-of-sale (PoS) malware to perform credit card fraud through a variety of methods, including blocking contactless payment transactions.

“Cybercriminals who compromise networks have the same end goal as those who carry out attacks via physical access: to dispense cash,” Trend Micro said in a detailed report on ATM malware published in September 2017.

“However, instead of manually installing malware on ATMs through USB or CD, the criminals would not need to go to the machines anymore. They have standby money mules that would pick up the cash and go.”