Products You May Like

Leading chipmaking nations including the U.S. are forming alliances, in part to secure their semiconductor supply chain and to stop China from reaching the cutting-edge of the industry, analysts told CNBC.

Places including the United States, South Korea, Japan and Taiwan, which have strong semiconductor industries, have looked to forge partnerships around the critical technology.

“The immediate reason for all this is definitely China,” said Pranay Kotasthane, chairperson of the High Tech Geopolitics Programme at Takshashila Institution, in reference to the alliances.

The teaming up underscores how important chips are to economies and national security, while at the same time highlighting a desire by countries to stem China’s advancement in the critical technology.

Kotasthane was a guest on the latest episode of CNBC’s Beyond the Valley podcast published Tuesday, which looks at the geopolitics behind semiconductors.

Why chips are in the geopolitical spotlight

Semiconductors are critical technology because they go into so many of the products we use — from smartphones to cars and refrigerators. And they’re also crucial to artificial intelligence applications and even weaponry.

The importance of chips were thrust into the spotlight during an ongoing shortage of these components, which was sparked by the Covid pandemic, amid a surge in demand for consumer electronics and supply chain disruptions.

That alerted governments around the world to the need to secure chip supplies. The United States, under President Joe Biden, has pushed to reshore manufacturing.

But the semiconductor supply chain is complex — it includes areas ranging from design to packaging to manufacturing and the tools that are required to do that.

For example, ASML, based in the Netherlands, is the only firm in the world capable of making the highly complex machines that are needed to manufacture the most advanced chips.

The United States, while strong in many areas of the market, has lost its dominance in manufacturing. Over the last 15 years or so, Taiwan’s TSMC and South Korea’s Samsung have come to dominate the manufacturing of the world’s most advanced semiconductors. Intel, the United States’ largest chipmaker, fell far behind.

Taiwan and South Korea make up about 80% of the global foundry market. Foundries are facilities that manufacture chips that other companies design.

The concentration of critical tools and manufacturing in a small number of companies and geographies has put governments around the world on edge, as well as thrust semiconductors into the realm of geopolitics.

“What has happened is there are many companies spread across the world doing small part of it, which means there’s a geopolitical angle to it, right? What if one company doesn’t supply the things that you need? What if, you know, one of the countries sort of puts things about espionage through chips? So those things make it a geopolitical tool,” Kotasthane said.

The concentration of power in the hands of a few economies and companies presents a business continuity risk, especially in places of contention like Taiwan, Kotasthane said. Beijing considers Taiwan a renegade province and has promised a “reunification” of the island with the Chinese mainland.

“The other geopolitical significance is just related to Taiwan’s central role in the semiconductor supply chain. And because China-Taiwan tensions have risen, there is a fear that, you know, since a lot of manufacturing happens in Taiwan, what happens if China were to occupy or even just that there are tensions between the two countries?” Kotasthane said.

Alliances being built that exclude China

Because of the complexity of the chip supply chain, no country can go it alone.

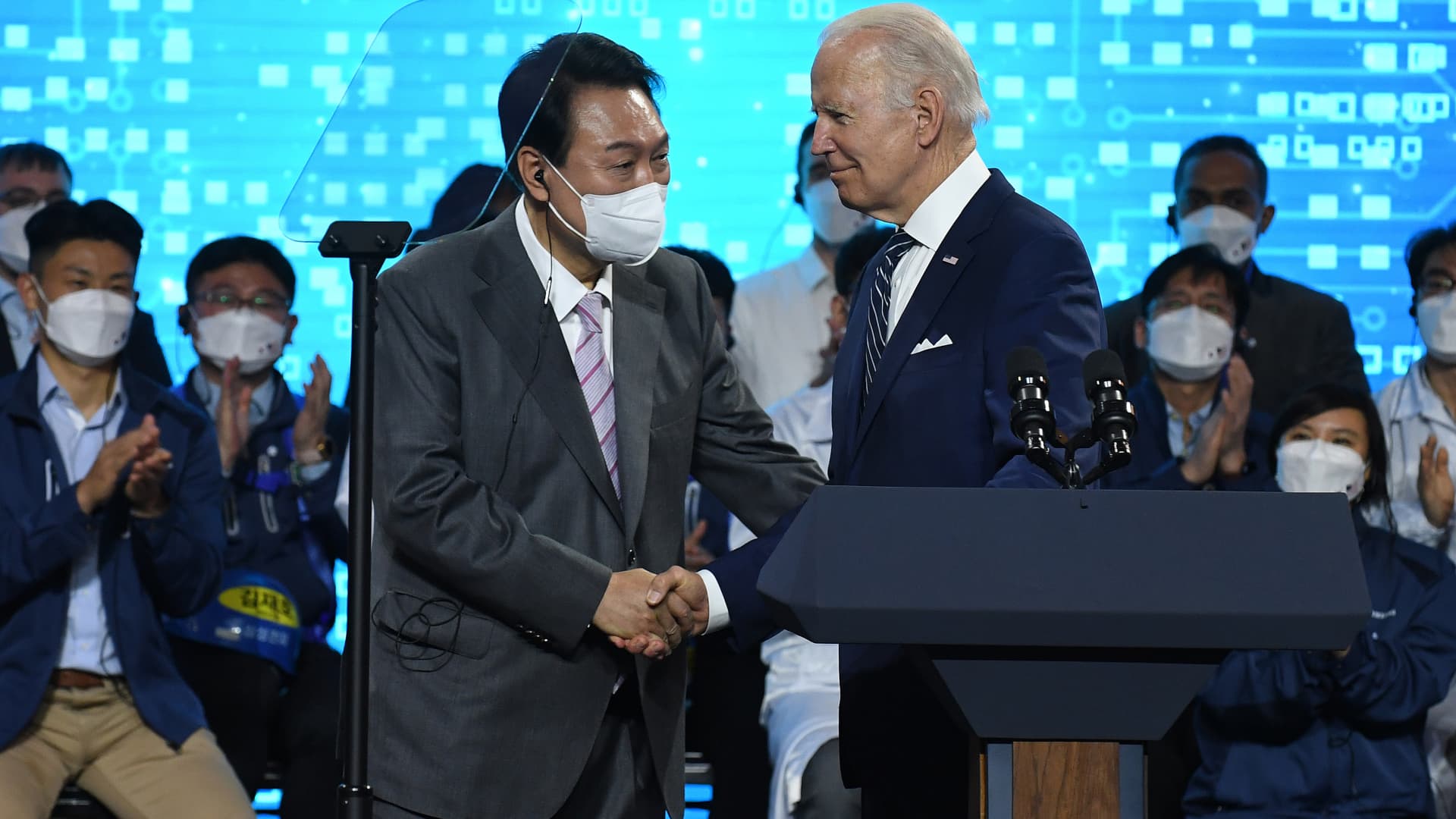

Countries have increasingly sought chip partnerships in the past two years. On a trip to South Korea in May, Biden visited a Samsung semiconductor plant. Around the same time, U.S. Commerce Secretary Gina Raimondo met her then Japanese counterpart, Koichi Hagiuda, in Tokyo and discussed “cooperation in fields such as semiconductors and export control.”

Last month, Taiwan’s President Tsai Ing-wen told the visiting U.S. state of Arizona Governor Doug Ducey that she looks forward to producing “democracy chips” with America. Taiwan is home to the world’s most advanced chipmaker TSMC.

And semiconductors are a key part of cooperation between the United States, India, Japan and Australia, a group of democracies collectively known as the Quad.

The U.S. has also proposed a “Chip 4” alliance with South Korea, Japan and Taiwan, all powerhouses in the semiconductor supply chain. However, details of this have not been finalized.

There are a few reasons behind these partnerships.

One is about bringing together countries, each with their “comparative advantages,” to “string together alliances that can develop secure chips,” Kotasthane said. “It doesn’t make sense to go it alone” because of the complexity of the supply chain and the strengths of different countries and companies, he added.

The push for such partnerships have one common trait — China is not involved. In fact, these alliances are designed to cut China off from the global supply chain.

“In my view, I think over the short term, China’s development in this sector will be severely constrained [as a result of these alliances],” Kotasthane said.

China and the U.S. view each other as rivals in technology in areas ranging from semiconductors to artificial intelligence. As part of that battle, the U.S. has looked to cut off China from critical semiconductors and tools to make them through export restrictions.

“The goal of all this effort is to prevent China from developing the capability to produce advanced semiconductors domestically,” Paul Triolo, the technology policy lead at consulting firm Albright Stonebridge, told CNBC, referring to the aims of the various partnerships.

China ‘cutting-edge’ chips in doubt

So where does that leave China?

Over the past few years, China has pumped a lot of money into its domestic semiconductor industry, aiming to boost self-sufficiency and reduce its reliance on foreign companies.

As explained before, that would be incredibly difficult because of the complexity of the supply chain and the concentration of power in the hands of very few companies and countries.

China is improving in areas such as chip design, but that’s an area that relies heavily on foreign tools and equipment.

Over the long term, I do think they [China] will be able to overcome some of the current challenges… yet they won’t be able to reach the cutting edge that many other countries are.Pranay KotasthaneTakshashila Institution

Manufacturing is the “Achilles’ heel” for China, according to Kotasthane. China’s biggest contract chipmaker is called SMIC. But the company’s technology is still significantly behind the likes of TSMC and Samsung.

“It requires a lot of international collaboration … which I think is now a big problem for China because of the way China has sort of antagonized neighbors,” Kotasthane said.

“What China could do, three, four years earlier in terms of international collaboration won’t just be possible.”

That leaves China’s ability to reach the leading edge of chipmaking in doubt, especially as the U.S. and other major semiconductor powerhouses form alliances, Kotasthane said.

“Over the long term, I do think they [China] will be able to overcome some of the current challenges… yet they won’t be able to reach the cutting edge that many other countries are,” Kotasthane said.

Tensions in the alliances

Still, there are some cracks beginning to appear between some of the partners, in particular South Korea and the United States.

In an interview with the Financial Times, Ahn Duk-geun, South Korea’s trade minister, said there were disagreements between Seoul and Washington over the latter’s continued export restrictions on semiconductor tools to China.

“Our semiconductor industry has a lot of concerns about what the US government is doing these days,” Ahn told the FT.

China, the world’s largest importer of chips, is a key market for chip companies globally, from U.S. giants like Qualcomm to Samsung in South Korea. With politics and business mixing, the stage could be set for more tension between nations in these high-tech alliances.

“Not all U.S. allies are eager to sign up for these alliances, or expand controls on technology bound for China, as they have major equities in both manufacturing in China and selling into the China market. Most do not want to run afoul of Beijing over these issues,” Triolo said.

“A major risk is that attempts to coordinate parts of the global semiconductor supply chain development undermine the market-driven nature of the industry and cause major collateral damage to innovation, driving up costs and slowing the pace of development of new technologies.”