Products You May Like

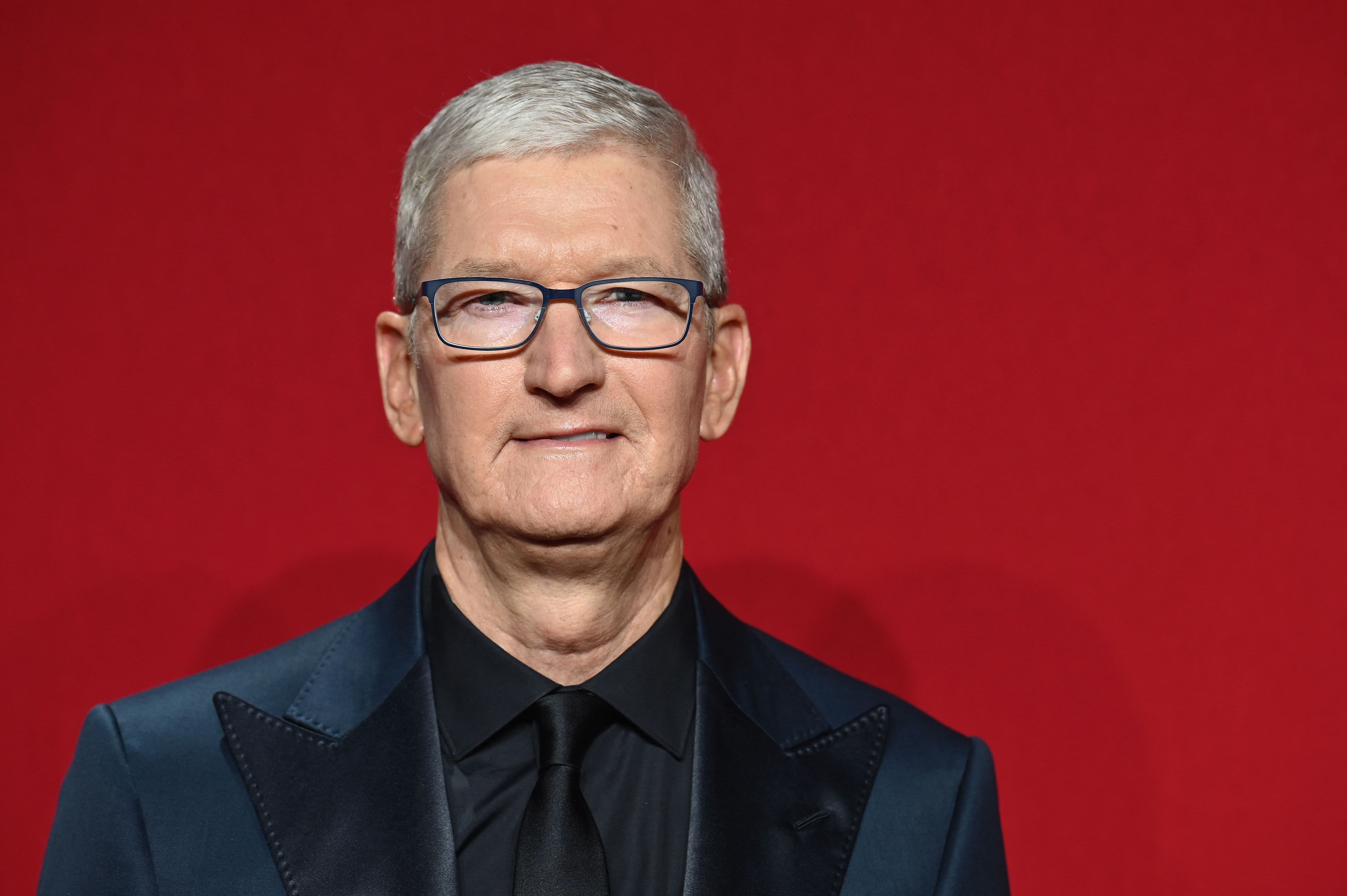

Apple brought in record revenue in India in the first quarter of the year, CEO Tim Cook said, as he touted the potential of what could become a key market for the tech giant in terms of iPhone sales and manufacturing.

During Apple’s earnings call on Thursday, Cook said that Apple set a “quarterly record” for its India business and saw “very strong, double digits year-over-year” growth.

related investing news

Apple does not disclose its sales figures in India. In its fiscal second quarter, Apple reported total revenue of $94.84 billion.

Gene Munster, managing partner at Deepwater Asset Management, told CNBC Thursday he estimates India accounts for just under 3% of Apple’s total revenue.

Investors have been focused on Apple’s potential in India after the tech giant recently ramped up its presence by opening its first physical stores in the country last month.

India’s smartphone market is dominated by low-cost Android phones, such as those offered by Samsung and Chinese players like Oppo and Xiaomi. But there is a growing middle class and consumers willing to spend more on expensive devices.

Smartphones priced above $400 now account for 10% of the total volumes of handsets shipped versus 4% before the pandemic, according to Counterpoint Research. This category of smartphones accounts for 35% of total smartphone market revenue.

Speaking of the opportunity that the India market presents, Cook said: “There are a lot of people coming into the middle class, and I really feel that India is at a tipping point, and it’s great to be there.”

India bigger than China for sales?

China has become one of Apple’s biggest markets and the company’s iPhones have become a hit with the country’s consumers.

Given India’s population is set to overtake China’s and many of the dynamics including a growing middle class are playing out, Apple is excited about its prospects.

Apple’s business in Greater China, which includes the mainland, Taiwan and Hong Kong, reported $17.81 billion in sales in the first quarter of the year, a decline in sales from the same period a year before.

Munster of Deepwater Asset Management said Apple CEO Cook is “laying the ground work that India can be big or bigger than China.”

“So all of your concerns, my concerns about China, at least on the demand side, they’re having a lot of success … in India. That’s a big deal because … you got to find large markets to go after, and after a decade they’re finally making traction in India.”

Munster was referring to concerns about a slowdown in China for Apple.

Still some have cast doubt on the potential of the Indian market for Apple. Richard Windsor, founder of independent research firm Radio Free Mobile, pointed toward a difference of gross domestic product per capita between the two nations, a metric often used as a broad measure of average living standards. China’s GDP per capita is more than 5 times the size of India’s, according to the World Bank.

“So while potentially lots of Indians would like to buy the iPhone, in terms of total numbers, in terms of the numbers that can actually afford it in India, it is probably going to be an awful lot less than China,” Windsor said.

Apple’s strategy in India is beyond just selling hardware, however. The company is also looking to India to become a key manufacturing hub as it looks to reduce its reliance on China.

Apple began assembling its flagship iPhone 14 in India last year — the first time that the company has produced its latest device in the country, so close to its initial launch. Piyush Goyal, India’s minister of commerce and industry, said in January that Apple is aiming to make 25% of all of its iPhones in India.